Introduction

I am sure at some point recently you have heard the term “multiple income streams” but what is multiple income streams about anyway?

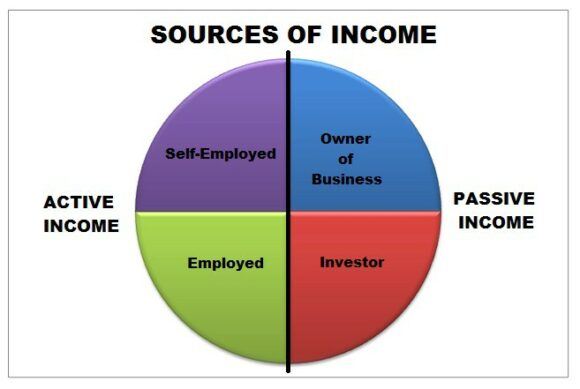

The benefits of having multiple incomes stream range from having some spare spending cash up to total financial freedom; a common thread amongst financially successful people is that they all had multiple incomes streams. There are two main types include active or passive, but what they all have in common is that they bring in some extra spending cash for those who don’t mind putting work into their businesses.

>>Check out my article on a way to start building another stream of income here >>

You need multiple income streams so that you can be more independent and spend your time on what matters most to you. Multiple income streams will help you with your financial future because they can diversify where your income comes from and reduce the risk of losing your income as well as can build up your wealth over time faster than just one source of income.

Multiple incomes streams come in different types which can be passive or active. With a passive stream of income, you do the work once and get paid over and over again for it. An example of this is making money from investments like stocks, bonds, and real estate.

Active streams of income are what most people think of when they hear the phrase “multiple income streams”. This is where you work and get paid multiple times for the same job. An example of this could be someone who has a day job and also does some freelance work on the side.

Ideally, you want to have more passive income streams so that you can free up your time and get to that financial freedom we all dream about.

What is multiple streams of income

Multiple streams of income, as the phrase suggests, means that you have income coming to you from more than one source. The book “Multiple Streams of Income” by Robert G. Allen explains it well. They are typically categorized between active and passive income. Passive income is the type of income that you only work on once and get paid over and over again for it. Active streams of income are what most people know what “multiple streams of income” means, which is where you work for one source of income and get paid multiple times for the same job like a typical day job.

Some examples of passive income streams include:

– Investing in stocks and bonds

– The process of investing in real estate and renting it out

– Teaching others what you know (e.g., becoming a tutor)

– Become a blogger and monetize your website

– Become an affiliate marketer and sell other people’s products online

– Start a business that can be scaled to where you don’t work in the business(active & passive)

Benefits of having multiple streams of income

There are a number of benefits to having multiple streams of income. These benefits can range from having some extra spending cash to having total financial freedom. Some of the most common benefits include:

– Increased financial security: This is one of the main reasons why people should have multiple streams of income. When you have your income coming from more than one source, it reduces the risk of losing your income if one stream dries up. It also allows you to build up your wealth over time faster than if you just had one stream of income.

– More independence: Having multiple streams of income gives you more independence because you’re not as reliant on any one source of income. This can be especially helpful you’re not happy with your current career and want to transition into something else.

– Work what you love: A common thread with financially successful people is that they all have multiple income streams which means it’s easier for them to work what they love rather than what just pays the bills.

How to get started with a second stream of income

Getting started with a second stream of income can seem daunting, but it’s not as hard as you may think.

Here are a few tips to help get you started:

1. Choose something that you’re interested in: When you’re picking a second stream of income, it’s important to choose something that you’re interested in. That way, you’ll be more likely to stick with it and not get burnt out.

2. Start small: Don’t try to take on too much at once. Start small and gradually increase your workload as you get more comfortable with the new venture.

3. Do your research: Make sure you do your research and have a solid plan before starting out. That way, you will sidestep costly mistakes that could have been avoided if you took the time to prepare.

4. Have reasonable expectations: It’s important to have reasonable expectations when starting out so that you don’t get discouraged. Remember, it takes time to build up what may seem like a small or inconsequential stream of income at first but typically as you put more of your time and energy into it the stream of income will go from a trickle to an ever flowing river!

5. Find what works for you: You may find that what works for someone else isn’t what works for you. It’s important to figure out what is the best fit and don’t be afraid to try different options until you find what works well.

How to choose the right side hustle for you

Before you start looking for what side hustle to do, follow these steps:

Step 1:

Choose what your goals are for this side hustle. Do you want a side project to make a little extra spending money on the weekends or monetize a hobby? Or maybe you want a second income stream that lasts for the long term?

Step 2:

Think about what your talents and skills are. This will help narrow down what type of side hustle you should pick from those that are available for what you’re good at. For example, if someone came up to me and ask what my talent is, I could say that my passion is playing guitar but I would not start a side business as a guitarist because I am not very good at playing the instrument. I am, however, good at selling online and could scale that to a business I could do on the side.

Step 3:

Decide what type of side hustle you want to do. A passive income stream that requires little to no work after the initial setup is complete or an active income stream where there is a direct correlation between the time you put in and the income that comes from that work?

Step 4:

Determine what your time availability is. If you’re working a full-time job, you probably don’t want to take on a side hustle that will require more than 10 hours of work each week.

Step 5:

Finally, what are your financial goals? Do you want to save up for a down payment on a house and just looking for extra cash every month or are you looking to start making something that won’t provide income right away but will give passive income potentially your whole life later?

Figuring out what side hustle is best for you can be tough, but it’s important to have your goals in mind before starting. If you’re not sure where to start, there are plenty of resources and guides on my page to help you in your journey.

How to create a passive stream of income

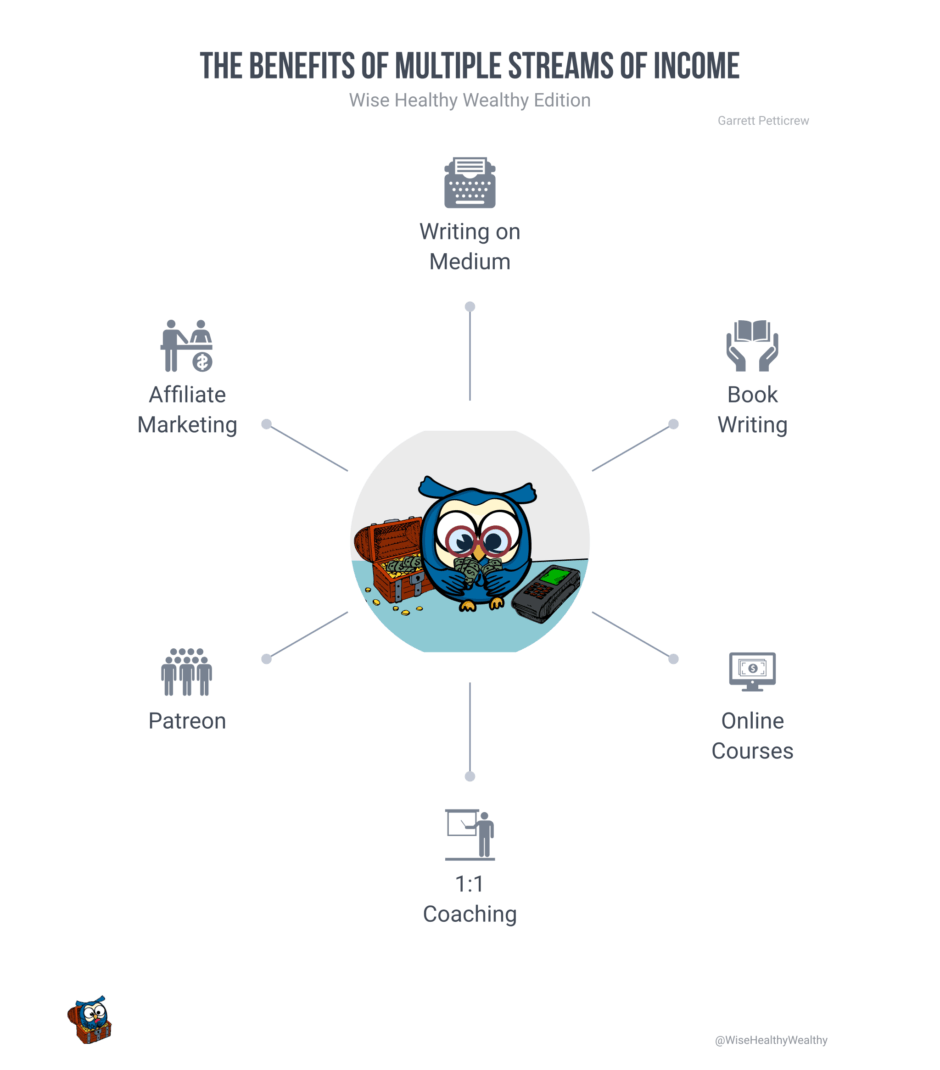

Passive streams of income are what make multiple streams of income strategy so marvelous. Most people can really only work one to two jobs that are active sources of income. Beyond that, there aren’t any more hours in the days and weeks to bring in more active income. Passive income, however, can be infinite essentially. Some require upfront capital while others require your time and knowledge or will to gain the knowledge necessary.

There are a few things you can do to create a passive stream of income:

1. Invest in dividend-paying stocks: When you invest in dividend-paying stocks, you’re essentially investing in a company that pays you back each year. Not only is this a great way to make money passively, but it’s also a great way to reinvest and compound your earnings over time.

2. Create an online course: When you create an online course, you’re setting up a system where people can learn from you at their own pace and convenience. This can be a great way to a passive income for years to come.

3. Get involved in real estate investing: One of the best ways to create passive income is by getting involved in real estate investing. When you invest in a property, you’re essentially setting up a system where you can collect rent payments each month without having to do much work.

4. Start a blog: When you start a blog, you’re setting up a system where you can share your knowledge and expertise with the world. Not only is this a great way to help people, but it can also be a great way to make passive income over time.

5. Create an information product: When you create an information product, you’re setting up a system where people can buy what you’re selling on an ongoing basis. This is essentially like putting your book on ”permanent” sale.

These are just some of the ways that you can create passive income streams. There are plenty more ways out there and figuring what works best for you can be difficult. If you’re not sure what type of passive income stream works best for you, check out some of my other articles and resources on my site to help get some ideas flowing.

What is Multiple Income Streams?

Multiple income streams can be what turns your average Joe into a millionaire. If you want to get started on the right foot and leave behind an unfulfilled life, it’s time to start thinking about what type of multiple income streams strategy is best for you.

Whether you start with an active or passive income stream, the most important thing to do is to start. Get another stream of income into your life, make it automated if possible, and then start another stream and on and on until you have the income you desire and that will give you financial freedom.

>>Check Out Our #1 Recommendation for Your Next Stream of Income Here!>>